Wednesday, 30 December 2015

Some of 2015's lowest Highlights

2015 was the year Crowdcube broke through the £100m invested barrier and the year they finally saw a funded company sold. Two in fact. Despite the returns being small, they are at least returns.

We said goodbye to quite a few Crowdcube funded businesses also in 2015. Most of the ones liquidated over the previous 3 years are also still in the process of closing. Losses for ECf have mounted and are now heading for the £20m mark.

The FCA continues to be AWoL and there seems little hope of them coming to the party in 2016. What exactly is it they are supposed to do? Answers on a postage stamp please.

Many companies labelled successes when they raised ECf continued to show spectacular form when it comes to missing projections.

Our award for the worst performing success story for 2015 has to go to Pizza Rossa - the self styled square pizza mafia. Two raises on Crowdcube and voted best business idea by the LBS and Crowdcube, this succail has broken all records when it comes to missing targets. We expect more of the same in 2016.

Worst performance by a ECf funded company is shared between Flavourly, whose reviews on Trust Pilot are a very amusing read, JustPark for likewise and Soshi Games who recently liquidated and seem to have lost their lead investor along the way. Some error with the AR apparently.

Quote of year as usual goes to Luke Lang, PRing director for Crowdcube, who told Altfi that of course Easyproperty investors would enjoy a considerable uplift in value despite dilution, after Stelio's namesake company raised a further £25m without entertaining Crowdcube investors. No figures then Luke - as usual!

Biggest fudge of the year - Camden Brewery sale with reported returns for ECf shareholders of 70%. Now looking a little dodgy that percentage.

Most resilient performance goes to Red Advertising, who having failed to raise yet more money on Crowdcube, have been successful in raising over £200k as a loan on Thincats. Of course the Thincats pitch didnt give details of the Crowdcube dealings.

Our quotes of the year - take your pick -

'Your blog should be essential reading for anyone interested in ECf' - an investor

'I wish the FCA would pay more attention to your writings' - an ECf platform - not Crowdcube!

'I love your blog. I discovered it today and couldn't stop until I had read every post. Truly insightful.' - a possible stalker.

Tip - keep your eyes open for a broadsheet article coming out shortly on a truly unbelievable phoenix event.

All the best for the NY & may at least some of your investments deliver a return in 2016!

Monday, 28 December 2015

Crowdcube 'success' Wild Trail files for closure

As we predicted Wild Trail is closing -

http://fantasyequitycrowdfunding.blogspot.co.uk/2015/09/when-did-ceo-start-to-stand-for-chief.html

On 29 December 2015 the company filed at CH for closure. The final accounts showed further losses and we assume the cash has run out. The fact that today is the 28 December helps to illustrate what we have said for a while, CH information is not accurate.

Crowdcube of course will put this down to survival of the fittest.

It would help however if they could try to publish pitches that had some chance of lasting more than 3 years before investors, 143 of them here, lose all their money. Some control over the ridiculous projections would not go amiss. Wild Trail's Crowdcube projections showed an impressive £4m turnover and £500k profit for 2015.

We are sure the NY will bring a healthy crop of new fantasies.

Happy Christmas to you all!

Tuesday, 22 December 2015

Camden Brewery Exit

Camden Brewery, who raised almost £3m on Crowdcube only this summer, have sold out to global drinks giant AB InBev.

The deal leaves the Crowdcube investors with a return of roughly 70%. Rumour is that AB paid around £85m. During the Crowdcube pitch the business was being valued at £50m. Not bad for a short journey.

It does seem odd that Camden would go to all the trouble of getting over 1000 investors on board and then sell up. Jasper Cuppaidge, friends and family who own 95% of the company are the real gainers. It must have been just too tempting to cash in. Maybe this deal was struck before the Crowdcube campaign and AB wanted to see the pulling power the brand had? Or maybe the thought of having to raise another £6m in the next two years was just too much for the owners. We will never know which is a shame.

It certainly isnt the story that was being sold by Camden only a few months ago during their successful pitch. Investors might wonder if they would have seen the promised 10X returns if the Cuppaidge's had not wanted to cash in. It's just one of the many dimensions that ECf investors have so little control over. Crowdcube have a standard drag along clause for all B shareholders and with the majority ownership in the family, even A shareholders (£25k) would have had no say.

The craft brewers are all crying foul and it is true that once smaller brewers get taken over by the big boys the quality falls - Doom Bar for example.

Camden investors were EIS eligible but clearly that is now no longer the case with this early exit. Interesting to know how many investors have already ticked their claim box on their self assessment forms.

Listening to the comments from Jasper Cuppaidge, you would be forgiven for thinking that this Camden Brewery was different to the one who raised money on Crowdcube only a few months ago. Now, he says, the company could not hope to prosper without the investment from a company of ABs size. Dont remember reading that in the Crowdcube plan.

We await the Crowdcube press release and the spin they create over this. Whilst it is a return, along with the E Car Club deal, it is nowhere near to the kind of return the platform promotes. So two exits to date, both of which have returned only a fraction of the wealth promised. Better than nout and almost certainly better than any future Camden brew.

Saturday, 19 December 2015

Why we need a regular format for information shown on ECf pithces

There is a current pitch on Crowdcube which is an excellent illustration of why we need some regulated format for the information ECf platforms publish.

In this pitch the financials have been presented in such a way as to heighten the net profit. This is done firstly by claiming the previous 12 months accounts were for the Group and that any amortisation or depreciation is taken into account at company level. Then for the projections, the company have used some accounting scheme which is not explained but appears to limit the depreciation to tiny a percentage of what is a large capex . It refuses to give any details of this accounting system because it claims it is commercially sensitive.

So the net result is, or more accurately could be, that the profits for this company as published in the Crowdcube projections, have been materially over stated. We have no way of telling. Crowdcube clearly didnt bother to check these things before the pitch went live. In fact its more likely that Crowdcube wouldnt spot these discrepancies anyway - they never have before.

No one here is breaking any laws; the whole area is a minefield. That's why it needs addressing

By filing all financial projections with an independent third party, sponsored by the government, and setting out some basic rules for how accounts are to be laid out, all of this could be avoided. If pitches didnt like the formatting, then its a good guess that what they are offering is not what it appears be.

In this way investors would have a much better chance of seeing a ROI and therefore ECf would have much better chance of a sustainable future.

In this pitch the financials have been presented in such a way as to heighten the net profit. This is done firstly by claiming the previous 12 months accounts were for the Group and that any amortisation or depreciation is taken into account at company level. Then for the projections, the company have used some accounting scheme which is not explained but appears to limit the depreciation to tiny a percentage of what is a large capex . It refuses to give any details of this accounting system because it claims it is commercially sensitive.

So the net result is, or more accurately could be, that the profits for this company as published in the Crowdcube projections, have been materially over stated. We have no way of telling. Crowdcube clearly didnt bother to check these things before the pitch went live. In fact its more likely that Crowdcube wouldnt spot these discrepancies anyway - they never have before.

No one here is breaking any laws; the whole area is a minefield. That's why it needs addressing

By filing all financial projections with an independent third party, sponsored by the government, and setting out some basic rules for how accounts are to be laid out, all of this could be avoided. If pitches didnt like the formatting, then its a good guess that what they are offering is not what it appears be.

In this way investors would have a much better chance of seeing a ROI and therefore ECf would have much better chance of a sustainable future.

Friday, 18 December 2015

Syndicate Room's Soshi Games mystery

Syndicate Room have made a big thing about their openness and honesty, especially when compared to other ECf platforms. It is certainly something ECf badly needs.

When Soshi Games went bust recently, SR's CEO, Goncalo de Vasconcelos, had the CEO perform in front of a camera to explain what had gone wrong. All in the spirit of openness you understand.

The video actually told us very little apart from the fact that the CEO didnt seem to understand some basic facts about how his market functioned. We thought at the time that if you wanted to cover something up, this would certainly be a good smoke screen.

As we pointed out elsewhere here, there is something rather odd about this company. All Syndicate Room pitches have Lead Investors. This one was no exception. The Early Advantage fund, run by Midven, were according to SR the Lead here.

Certainly if you check the ARs for the company, they are a substantial shareholder. That is until just before the business' collapse. In the final AR their holding has vanished - it's simply not there on the list of shareholders. So whilst all the other investors and creditors are sitting licking their wounds, it would appear that Midven got out in the nick of time. That's what you call leading from the front. Of course it could be an error with the AR.

So we asked both Midven and SR what had happened. Midven never replied but Goncalo has. SR do not see anything amiss with what has happened and it seems likely that the information is privileged. Door shuts.

Ours wasnt a difficult query - what has happened to the large shareholding that SR's the Lead investor had in this company?

Given that the holding disappeared just before the company went bust, owing investors and creditors well over £1m, it seems a fair ask. Of course it is possible to hide behind client confidentiality - it always is. However it says a lot for SR's openness claim that they would even consider trying that one.

We'll keep digging, it may all be perfectly innocent and above board. Only the facts will tell us that. At the moment, the facts show the Lead investor had left the building before it fell on everyone else.

When Soshi Games went bust recently, SR's CEO, Goncalo de Vasconcelos, had the CEO perform in front of a camera to explain what had gone wrong. All in the spirit of openness you understand.

The video actually told us very little apart from the fact that the CEO didnt seem to understand some basic facts about how his market functioned. We thought at the time that if you wanted to cover something up, this would certainly be a good smoke screen.

As we pointed out elsewhere here, there is something rather odd about this company. All Syndicate Room pitches have Lead Investors. This one was no exception. The Early Advantage fund, run by Midven, were according to SR the Lead here.

Certainly if you check the ARs for the company, they are a substantial shareholder. That is until just before the business' collapse. In the final AR their holding has vanished - it's simply not there on the list of shareholders. So whilst all the other investors and creditors are sitting licking their wounds, it would appear that Midven got out in the nick of time. That's what you call leading from the front. Of course it could be an error with the AR.

So we asked both Midven and SR what had happened. Midven never replied but Goncalo has. SR do not see anything amiss with what has happened and it seems likely that the information is privileged. Door shuts.

Ours wasnt a difficult query - what has happened to the large shareholding that SR's the Lead investor had in this company?

Given that the holding disappeared just before the company went bust, owing investors and creditors well over £1m, it seems a fair ask. Of course it is possible to hide behind client confidentiality - it always is. However it says a lot for SR's openness claim that they would even consider trying that one.

We'll keep digging, it may all be perfectly innocent and above board. Only the facts will tell us that. At the moment, the facts show the Lead investor had left the building before it fell on everyone else.

Thursday, 17 December 2015

Flavourly reviews cannot get any worse - can they??

Flavourly have featured here before. They raised £100k on Angles Den and then £500k on Crowdcube. All of their 'success' is based in Groupon - its a mirage and not a very pretty one.

You wouldnt believe the reviews on Trustpilot - https://uk.trustpilot.com/review/www.flavourly.com. There are plenty more bad ones since we last flagged this up and now Flavourly are fighting back. They are having poor reviews removed. This is not the way to garner customer satisfaction but then if you go about your customer acquisition campaign by using Groupon, it is to be expected.

To be honest its a shambles and if we had invested we would want to know what the blank is going on. At the moment this is classic study in how not to start up a successful business.

Wednesday, 16 December 2015

Stickyboard raised £56k on Crowdcube last year.

In the pitch they planned to raise another £200k that year - presumably to activate the plans that was projected to give them a handsome £62k profit.

Clearly something went wrong and accounts for YE March 2015 show a loss of £50k which leaves the company with a negative book value of just under £200k. Capital raised was only £65k.

So as with nearly all Crowdcube pitches, the financial projections have turned out to be total nonsense. Investors seem to have been led to believe that the extra £200k was a given. Failure to raise this is a good enough explanation for the continuing losses. Working capital being an essential.

It would be nice just once and while to report on a company financed through Crowdcube that has got somewhere close to its projections.

Soshi Games update

Soshi Games raised £285k on Syndicate Room in April 2014.

The company went into liquidation this October.

We commented before here about the SR's video they had asked the CEO to produce, which tried to explain the business' failure. It was a refreshing approach for an ECf platform to show some concern for its investors.

As part of this crowdfunding, as with all SR pitches, Soshi had a Lead investor - the Early Advantage Partnership, part of Midven.

So when the last AR was filed, it was strange to find that the Early Advantage shareholding was no longer listed. It had been in the previous years' ARs.

Shortly after this last AR, the company folded. In the liquidators initial report Midven is listed as a creditor owed £10k. When you consider that the company had raised £1.4m in capital, £10k is not taking much of lead. The report also shows that £85k of share capital remained unpaid.

We have asked both Syndicate Room and Midven if they can caste some light on what happened to this shareholding. And also to comment on the fact that whilst the Lead investor seems to have off loaded their holding in the company, the likes of Creative England have lost all of their £150k investment, along with a large number of creditors. Not forgetting of course all the crowd investors.

We havent had any answers yet. As SR pride themselves on their open approach we assume one will be coming shortly.

The company went into liquidation this October.

We commented before here about the SR's video they had asked the CEO to produce, which tried to explain the business' failure. It was a refreshing approach for an ECf platform to show some concern for its investors.

As part of this crowdfunding, as with all SR pitches, Soshi had a Lead investor - the Early Advantage Partnership, part of Midven.

So when the last AR was filed, it was strange to find that the Early Advantage shareholding was no longer listed. It had been in the previous years' ARs.

Shortly after this last AR, the company folded. In the liquidators initial report Midven is listed as a creditor owed £10k. When you consider that the company had raised £1.4m in capital, £10k is not taking much of lead. The report also shows that £85k of share capital remained unpaid.

We have asked both Syndicate Room and Midven if they can caste some light on what happened to this shareholding. And also to comment on the fact that whilst the Lead investor seems to have off loaded their holding in the company, the likes of Creative England have lost all of their £150k investment, along with a large number of creditors. Not forgetting of course all the crowd investors.

We havent had any answers yet. As SR pride themselves on their open approach we assume one will be coming shortly.

Monday, 14 December 2015

Newgalexy Services files accounts 7 months early

Newgalexy Services raised over £200k on Crowdcube back in 2014.

As part of this raise the pitch stated that the company had secured £550k in finance through equity and grants. The Crowdcube pitch would make this figure up to the required £650k.

Somewhere these figures do not add up. Further grants assumed seem to have dried up - possibly as they were reliant on KPIs that were not met. Total equity investment is static at £360k.

Anyway the latest accounts, filed 7 months early, for YE October 2015 show revenues of £835k against projected revenues of £3.38m. Some gap.

The good news for investors is that due to stringent cost cutting, the company has managed to make a profit. Ok so its only £90k against a projected profit for the year of £1m but we all understand that no one pays any attention to projections.

Why they have chosen to file so early is a mystery but we may be about to see them reappear for a new equity raise. It makes you wonder if the company had had the balls to use projections closer to their real achievements, whether they would have raised the Crowdcube money. Investors have to hope they can continue on their now slow progress to the promised exit.

As part of this raise the pitch stated that the company had secured £550k in finance through equity and grants. The Crowdcube pitch would make this figure up to the required £650k.

Somewhere these figures do not add up. Further grants assumed seem to have dried up - possibly as they were reliant on KPIs that were not met. Total equity investment is static at £360k.

Anyway the latest accounts, filed 7 months early, for YE October 2015 show revenues of £835k against projected revenues of £3.38m. Some gap.

The good news for investors is that due to stringent cost cutting, the company has managed to make a profit. Ok so its only £90k against a projected profit for the year of £1m but we all understand that no one pays any attention to projections.

Why they have chosen to file so early is a mystery but we may be about to see them reappear for a new equity raise. It makes you wonder if the company had had the balls to use projections closer to their real achievements, whether they would have raised the Crowdcube money. Investors have to hope they can continue on their now slow progress to the promised exit.

Sunday, 13 December 2015

Getting ECf right - 7 essentials to reaching the summit and raising your funding

ECf pitches and campaigns vary enormously. Having studied many hundreds since 2011, we know what makes for a good campaign and what will end in tears.

Here are our 7 essentials to a successful Equity Crowdfunding Campaign -

- Prepare Make sure you have a group behind you ready to invest before you launch - an initial hit to take you as close to 33% funded as possible has been shown to be key. Be sure that you have prepared yourself and anyone helping for 2 months of hard and often frustrating work - taking you away from your day to day business routines. Ensure your accounts are up to date and that you have filed with CH early if this is possible.

- Plan Ensure the explanation of the business model is clear and easy to understand. Have a viable marketing plan and workable budget - you need to thoroughly understand how these will work to deliver future revenues. Do not have fantastic growth figures you can only back up with 'hope so'. Platforms may try to persuade you to up your ambitions - only do this if you are comfortable with them. Traction should be real ie dont use Groupon or similar to inflate customer numbers. There is no point in taking peoples money if you never had a chance of delivering what you promised.

- Value your business so that investors feel they are getting a bargain - this should be based on a value today plus an uplift for the potential. Dont use DCF or NPV formulas - they are simply not relevant for early stage or start up businesses. Remember you want people to risk their cash so do not be greedy. 50% of something is worth a lot more than 90% of nothing.

- Connect Answer all forum questions promptly, politely, professionally and honestly - however irritating and stupid they maybe. Arrogant answers where entrepreneurs assume they know best are disastrous. Investors like to feel they know what they are talking about, so help them out. Check the forum is working properly at least once a day. It is possible to persuade people to invest and likewise the wrong approach will put them off. Update forums with important news about the business but dont flood them.

- Momentum Arrange for some friendly investors to put their money in in stages as opposed to one lump - this will keep you high on the list of pitches and make the pitch look active. Ensure you arrange an Investors Meeting to take place about half way through your pitch, dont leave it till the end. Be well prepared with a well thought through presentation.

- Push The pitch will hit a brick wall at some stage - get your list of contacts and work them to restart it. Dont give up. If people say they would consider investing at a lower valuation then look seriously at this option. Be prepared to over fund as this will get you on average another 20% in capital and its easier to get the funding now than to have to go again later.

- Rewards If you can, be generous with your rewards - look at the long term benefits no the sort term hit. Smaller investors are often happy to take a punt on the rewards alone if they are enticing. Imagine you are just pre selling products/services at a discount.

Saturday, 12 December 2015

John Taysom invests in Skin Analytics

Skin Analytics have been trying to raise £450k on Crowdcube for sometime now - they have extended their time frame at least twice. We wrote about them here fantasyequitycrowdfunding.blogspot.co.uk/search?q=+skin+analytics

It looked very likely that they wouldnt make it - the offer had been misdescribed in the pitch and it seemed people had lost interest.

Now the pitch is about to close with over £500k of funding including investment from John Taysom. The last £50k of overfunding coming in just a few days.

Taysom is well known for his ability to pick a winner so this development is one for consideration. He has invested in over 100 start ups and to date 18 of those have IPO'd, mainly on the Nasdaq.

To be honest we didnt rate this company - a link up with what appears to be a poor service by Vitality UK and the blatant use of misinformation in the pitch wasnt to our liking.

We would be happy to be wrong however and Taysom's involvement suggests that may well be the case. You have until midnight tonight to jump on board.

It looked very likely that they wouldnt make it - the offer had been misdescribed in the pitch and it seemed people had lost interest.

Now the pitch is about to close with over £500k of funding including investment from John Taysom. The last £50k of overfunding coming in just a few days.

Taysom is well known for his ability to pick a winner so this development is one for consideration. He has invested in over 100 start ups and to date 18 of those have IPO'd, mainly on the Nasdaq.

To be honest we didnt rate this company - a link up with what appears to be a poor service by Vitality UK and the blatant use of misinformation in the pitch wasnt to our liking.

We would be happy to be wrong however and Taysom's involvement suggests that may well be the case. You have until midnight tonight to jump on board.

Friday, 11 December 2015

Crumpet Cashmere liquidation - A tale of two goats.

Crumpet Cashmere was an accident waiting to happen.

The founders had already gone bust once owing £750k, done a prepacked deal which stated they were not be directors of the new Crumpet Cashmere, made themselves directors, raised money on Crowdcube and then only months later have gone bust again owing over £400,000 to creditors and shareholders.

So to date these two have cost almost £1.2m in terms of lost money in the space of 2 years. It would have been cheaper to pay them to stay at home.

As a final ironic twist Crowdcube are listed in the o/s creditors, owed a sum of £3,500.There is no money to pay anyone.

So why did so many people back these two? Beats us although it has a lot to do with the the way the pitch was allowed to be portrayed by Crowdcube - the previous failure was for example not mentioned until we brought it up in the forum.

It is an all too familiar story.

PS - you can expect this story to run as we find out just what has happened to Crumpet and its shareholders and creditors. Expect the unexpected!

Thursday, 10 December 2015

How could such a well run business go bust after raising £500,000 on Seedrs?

Upper Street has some serious press - see here http://www.crowdfundinsider.com/2015/02/62502-upper-street-the-luxury-made-to-order-shoe-firm-connects-with-seedrs-hits-the-pavement-to-raise-200k/

And recently this in the Times - https://www.linkedin.com/pulse/why-going-bespoke-make-you-stand-out-from-crowd-julia-elliott-brown?trk=hb_ntf_MEGAPHONE_ARTICLE_POST

including this -

- Backed by leading VC Venrex (NotOnTheHighStreet, JustEat, Smythson), and the British Business Bank.

- Double-digit annual revenue growth*, thousands of customers acquired; 20% repeat purchase rate.

- 91% of customers would refer Upper Street to a friend. <5% product return rate.

- High profile customers include Helena Bonham Carter, Erin O’Connor, Jodie Kidd and Tess Daly.

- Strong social media following: 51,000 Facebook fans, 4,000 Twitter followers.

- Acquisition of US competitor Milk & Honey in 2014.

- Phenomenal press coverage includes Marie Claire, Elle, InStyle, Stylist, Times, Guardian, Daily Mail, Telegraph and Evening Standard.

- An ASTIA company 2012; female-led high growth potential company.

- Wonga Future 50 Real Business award winner 2012; new entrepreneurial businesses triggering change in their market.

- Shortlisted for Drapers Footwear & Accessories 2013 award for Growing Business / Brand.

- Shortlisted for PayPal eTail Awards – Best Small Pureplay Etailer 2013.

so it is hard to understand the comments on the company's Facebook page -

Hi Pippa, thanks for getting in touch. The team at Upper Street have decided to pursue new endeavours, and as a result the business will be closing its doors. Upper Street customers are now being welcomed into the Shoes of Prey family. You can read more about it here: https://www.shoesofprey.com/articles/3179929246/upperstreet Do let me know if you have any further questions.

- Chloé, from Shoes of Prey x.

According to the Shoes of Prey, they will honour any replacements etc but have nothing to do with creditors or seemingly shareholders.

The company appears to have lost all of the £500,000 invested this year via Seedrs, not to mention £1m plus from previous investments by Venrex and the British Business Bank.

We have asked Seedrs to respond..........

Seedrs have now responded.

They say the company failed to raise another round on Seedrs this October. Apparently most new start businesses go bust.

We find it hard to believe that this business which had won so many awards, was according to them and the Seedrs pitch, doing so well only months ago, had official government backing as well as VC backing, has now suddenly closed. Something is not right.

What would help investors would be for all ECf platforms to publish their failures with some notes, so that over time it might be possible to build up a better picture of what will work and what wont. Of course the chances of this happening are small but you guys should really be asking the question.

Wednesday, 9 December 2015

3 companies funded via equity crowdfunding close in one day

Crumpet Cashmere, Upper St and MRC Bartending have all raised money via equity crowdfunding and as of today have all ceased to trade. They join the growing list of failed businesses that have used this form of funding.

Crowdcube, Seedrs and Bank to the Future were their respective platforms. But the real question is will any of them tell the true story behind these failures?

We doubt it.

UPDATE 27 Jan 2016 - MRC Bartending has now brought itc Co back to life - it hasd been struck off. Odd though that the new AR01 has no shareholders listed at all!!

Crowdcube, Seedrs and Bank to the Future were their respective platforms. But the real question is will any of them tell the true story behind these failures?

We doubt it.

UPDATE 27 Jan 2016 - MRC Bartending has now brought itc Co back to life - it hasd been struck off. Odd though that the new AR01 has no shareholders listed at all!!

These shoes were made for walking - Seedrs pitch fails

Firstly thanks to Gordon Gekko who drew our attention to this - before it was listed at CH!

Upper St have raised ECf on Seedrs but have now decided to close. See here https://www.shoesofprey.com/articles/3179929246/upperstreet.

Investors included The British Business Bank and Venrex Partners and before the Seedrs raise the business was valued at £2.8m.

They have sold their assets to the Australian company Shoes of Prey, who seem delighted. Apparently the founders of Upper St decided it was time to do something else.

Not too sure how delighted the investors in Upper St will be.

It seems these shoes really did walk all over you.

Crumpet Cashmere had already done a prepacked deal - when wiil we learn?

This is fast becoming a farce.

Crumpet England went into Administration in 2012. The company was the same as the one that has just collapsed.

In the report the administrators have a pre packed deal with a company called Crumpet Cashmere Ltd. CC plan to buy the assets of Crumpet England for £80k - they eventually paid only £60k.. This left the company with a deficit of £750,000 owed to a mix of banks and creditors.

It stipulates in this deal that the two founding directors of Crumpet England are not allowed to be directors of the newco. It states they will be 'employees'. In September 2013 both become directors of the newco Crumpet Cashmere and the 'director' put there by the administrators resigns. The final closure of Crumpet England only took place in October 2014, a whole year after these two had been made directors.

By March 2014 these two schemers are raising money on Crowdcube.

Now it remains to be seen if they will try this tactic again but I wouldnt put it past them.

Surely we need new rules for prepacked deals - you simply cant have people carrying on like this without any recourse for those they steal from.

This one has to be fraud

Crumpet Cashmere has called in the liquidators only a little more than a year after they raised £163k from 112 investors on Crowdcube.

This company had already gone bust once in 2012. The founders assured investors that lessons had been learnt but in the short period since the Crowdcube raise was finalised in July 2014, they have managed to burn the cash and close. Of course they have managed to pay off an outstanding charge.

This is hot off the press at CH so we dont yet have the final picture but will post it as soon as.

Clearly these people should not have been allowed out with a business again and certainly not allowed to use Crowdcube or any ECf platform to rip off the public.

Unfortunately with lite touch regulation and the ECf's platforms very poor due diligence, this is will become the norm rather than the exception.

Crowdcube are shareholders and so will know about this collapse - how long before their Undertakers Dept have removed all traces, is anyone's guess. These are busy times for the box makers.

More to follow on this one.

This company had already gone bust once in 2012. The founders assured investors that lessons had been learnt but in the short period since the Crowdcube raise was finalised in July 2014, they have managed to burn the cash and close. Of course they have managed to pay off an outstanding charge.

This is hot off the press at CH so we dont yet have the final picture but will post it as soon as.

Clearly these people should not have been allowed out with a business again and certainly not allowed to use Crowdcube or any ECf platform to rip off the public.

Unfortunately with lite touch regulation and the ECf's platforms very poor due diligence, this is will become the norm rather than the exception.

Crowdcube are shareholders and so will know about this collapse - how long before their Undertakers Dept have removed all traces, is anyone's guess. These are busy times for the box makers.

More to follow on this one.

Tuesday, 8 December 2015

A service that will help SMEs raise ECF.

Raising money via Equity Crowdfunding is not easy.

It is time consuming, can be frustrating and if you get it wrong will eventually be non productive. So its better to get the process right from the outset.

We have studied and analysed a great number of sucesfull and failed campaigns since ECf started in 2011. We know which platforms offer the best opportunities for a variety of different companies and funding requirements.

Our operation is run by someone who has founded and sold companies and been involved with start ups for 30 years. With a Cranfield MBA and hands on experience in equity crowdfunding, both as an entrepreneur and an investor, this experience could help you be successful in your campaign.

Its free.

In keeping with the whole Crowd ethos, we dont take an up front fee. We will look at the business and the pitch and then decide if we think it has a chance of raising its target. If we feel we can help then we will provide a hands on service to the point of the pitch launch and continue to advise whilst the pitch runs. Only if the pitch is successful and the money raised will we take a percentage of the capital and an equity stake in the company. We like to back our own judgements.

So you have nothing to lose. We can help you summit.

Contact us now via this blog site and we will respond on email to start the process.

Is this comedy really what we want to achieve through equity crowdfunding?

Videogam Worldwide raised £53k on Crowdcube at the turn of the year. Its a start up in the greeting card market.

In this Crowdcube pitch, the headline was - ''VideoGram have signed a deal with Argos and are currently in talks with Harrods to discuss listing their product.''

Impressive stuff and as we all know this sort of claim is checked by the out to lunch department at Crowdcube, thoroughly.

Videogram Worldwide have just completed a new raise on a site that we havent come across before, Crowd for Angels https://crowdforangels.com/company/Videogram-worldwide-ltd-42

They have raised another £50k of what they describe as seed funding.

Now the really interesting bit about all this is that the sales to date of their products are just under £10k. There is no mention anywhere, at all, of the signed deal they had done with Argos - the one that was the backbone of their Crowdcube raise. Unluckily the company also seems to have failed to follow through with its Harrods deal. We assume the meagre turnover has come from the website, where the reseller page is empty.

In the new pitch the company have launched two new products - not something the first raise highlighted. So the having failed with one lets try another two shall we approach.

The new pitch states - ''Having three brands within the company puts us in a great position compared to other businesses;

For example; should we want to liquidate some of our assets we can sell one of our brands injecting cash in to the business.'' Hmmm.

On marketing they say -

''We aim to invest £50,000 in marketing VideoGram over the next 6 months to give it a real push and achieve the forecast figures we have projected. We believe this amount will be required to really test the market and give VideoGram a chance to compete with the big players in the industry.'' :))

The exit section really seals the deal for us -

''The Company aim is to be brought out within 3 years. It is likely companies such as Photobox and Moonpig would have the greatest interest in acquiring us due to their buying trends over the last few years. We believe a conservative estimate at that stage would be approximately £5-£10million.'' Thats a cert then.

Seemingly the 11 people who invested agree with them.

Monday, 7 December 2015

Who won, the Tortoise or the Hare?

We seem to be living in a world of amaranthine discounts attuned to unrealistic expectations.

This is a problem if you want businesses to make money.

We have already written about businesses making claims about their staggering customer acquisition numbers - see Flavourly post. The problem for investors is that if the businesses dont tell us they are using an aggressive campaign with Groupon to artificially boost these numbers, it can be very hard to tell. The platforms promoting these businesses do not bother to check.

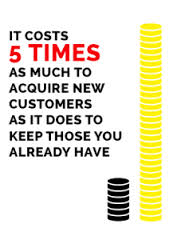

We see another Crowdcube pitch , Kabee, has been using promo codes to boost business. This comes down to same thing - selling your service or product at close to cost to woo customers. It all seems to be wound up in our modern day desire to have everything yesterday. Where businesses used to take time to grow and gain traction, Groupon et al now allow the illusion of traction immediately.

However building up businesses with customers gained through discounting is like building your house on a sand bank. These customers have no loyalty - look at Kabee's retention figures. They flit from one bargain to the next and there are plenty of them out there. Meanwhile your costs grow as planned until a time when falling revenues dip below them and then its bye bye. Its a new form of over trading but unlike the classic SME curse, it is entirely preventable.

However building up businesses with customers gained through discounting is like building your house on a sand bank. These customers have no loyalty - look at Kabee's retention figures. They flit from one bargain to the next and there are plenty of them out there. Meanwhile your costs grow as planned until a time when falling revenues dip below them and then its bye bye. Its a new form of over trading but unlike the classic SME curse, it is entirely preventable. We need a change in the mindset of our entrepreneurs. It maybe a story from a bygone era but the hare did not win the race; the tortoise did.

Do we need another me2 Equity Crowdfunding site?

The one thing the UK is crying out for is a new look Equity Crowdfunding site.

One where pitches are thoroughly vetted, by an experienced team. One where the valuations are sensible in terms of risk and reward. One where projections are ambitious but not ludicrous. And one essentially where we can start to build sustainable SMEs with the Crowd's money, rather than building ECF platforms for their own sake.

Investden has just appeared on the radar.

The team behind this venture appears to have plenty of business experience or so they tell us. The evidence on the site tells a different story.

Once again we have inflated valuations and financial projections that can be seen from space. Most of the live pitches have very few 'investors' putting in large sums. For example one pitch looking for £1.4m has only one investor to date who put in just over 1m. What the..?

You can see how carefully the platform has considered its offer in the way it presents its financials. For all Crowdcube's many failings, they do at least know how to present. Investden have gone for the RAW technique or to put it another way they havent bothered to change the excel sheets at all. Each pitch has different excel sheet data presented in an essentially unintelligible form.

One aspect of the platform that intrigued us was the attempt to create a secondary market. Attempt might be too strong a word here but at least they have recognised the problem. They have two trades on offer, both in shares from ex Crowdcube pitches. Amusingly the reason given for 'selling' these shares is liquidity. The value of each transaction is £100! Its impossible to take it seriously.

So this new player is just more of the same old rubbish. Surely we can do better.

Sunday, 6 December 2015

Is this the worst customer service company ever?

Flavourly is an Edinburgh based online snack box company. It won some notoriety when it pitched succcesfully on Dragons Den only to turn down the eventual offer.

Flavourly's ratings on Trust Pilot are hard to believe. Most recent ones go 2 star, 1 star, 1 star, 1 star, 2 star, 1 star, 2 star, 2 star, 1 star and 2 star. You can take it that these 10 customers will not be back. You can also assume that anyone reading these will not go any further down the page and will not be ordering. Negative word of mouth is a killer.

Flavourly initially raised just over £100k on Angels Den. They then raised over £500k in 2015 on Crowdcube following the events on the Dragons Den.

So why are their customers so unhappy?

We supsect that it has a lot to do with the way they use Groupon. This blog has highlighted this before. Aggressive customer aquisition campaigns on Groupon are not a good way to build a sound business. Flavourly majored on this technique and continues to do so. Their whole Crowdcube campiagn was centred on the large numbers of customers they had attracted. They just failed to say how this had been done it. You might ask why Crowdcube didnt pick up on this oversight but you'd be wasting your time.

Groupon doesnt supply customers, it supplies impulsive bargain hunters who have no brand loyalty and will desert you for the next best offer in a second.

Flavourly clearly have not designed a customer interface that works to even a basic level. So many very poor reviews indicate fundamental problems with the model. Far too much time spent on customer acquisition and not enough on customer retention. Accounts due out in May 2016 will reveal more.

PS - Flavourly are featured in this years Crowdcube Christmas Gift ideas - with a discount coupon of couse!

Saturday, 5 December 2015

Affresol show further losses but raise £850k

Affresol is good example of what happens to companies after they fund on Crowdcube.

The business raised capital on the platform in 2013 - on the pitch projections that showed a profit for 2015 of almost £3.5m. We posted on them in March this year.

Accounts filed for YE May 2015 show further losses, £320k for the year and £1.8m accumulated.

Clearly people believe in this product as the recent £245k Welsh Government grant and further funding rounds have shown.

It remains to be seen if it will deliver and if the Crowdcube shareholders who have been hugely diluted will see a return if it does.

Yet again the gap between the predictions on Crowdcube and the outcome has so far been on scale that is incredible even for this platform. Just another example, if more were needed, that all Crowdcube pitches use projections devoid of any grasp on reality.

Is Crowdcube's poor Due Diligence in the company's DNA?

There is a lot to be said for leading by example. However it does depend on the example set.

On the Crowdcube site this is the bio for their CEO, founder, and winner of multiple awards, Darren Westlake -

Darren Westlake, CEO, Co-founder

A serial entrepreneur, Darren started his first company aged 26 and has since built and sold two companies. His background is in telecoms, technology and internet.

Darren Westlake's main recorded (CH) business activity is with his own ID Telecomms Ltd from 2000 to its collapse in 2006, subsequent pre packed sale and final closure.

This company was sold for £50k by the Westlake brothers according to the liquidator's report, on 15 January 2006 to Telecomplete Ltd, who then two weeks later, put it into administration and repurchased its goodwill and chattels for £20k. All very, very strange.

There is little record of Telecomplete Ltd but what we have found suggests the company was incorporated only a few days before it 'bought' ID Telecomms and was then closed. One report shows Telecomplete became part of the The Fused Group Ltd which went into administration and was closed in 2010.

According to the liquidation documents, ID Telecomms had made a little money initially in 2003; an £80k profit on a t/o of £7m. It had not been able to change with the market trends and was soon being undercut and making substantial losses. Its unclear why Telecomplete purchased it in January 2006 to only put it into administration on the 1st February, having paid £50k for the shares. The report states that The Westlakes had been having discussions about a possible sale with Telecomplete during 2005. Records show Telecomplete was incorporated on 16 December 2005.

The report also states that mounting losses were the cause but that makes little sense in looking at the dates. No share transfer to Telecomplete or anyone else is filed at CH. Darren Westlake is reported to have resigned from ID Telecomms about the time it was sold but there is no filing at CH.

According to the final accounts for ID Telecomms, £152,000 had been invested in its share capital. So even ignoring all of the above, a sale for £50k is still a large loss.

Apart from this company, Westlake has no successes prior to setting up Crowdcube that are recorded at CH. There have been a number of non trading companies and three other insolvencies. Post 2006 he went to work for KCom Group.

It is of course possible that the successes were not with Limited Companies. Naming them would help settle that issue.

Its in the nature of business that people will fail - nothing wrong with trying something even if it doesnt work. Better to have tried and failed than to have not tried at all. But ignoring or embellishing the facts is wrong. It is certainly wrong and unacceptable if you are promoting this information for commercial gain.

What investors would like is for the information on sites like Crowdcube to be transparent. So when a claim is made that so and so is a serial entrepreneur and has sold three businesses, can we please have the names of the businesses and the dates.

Its easy now to explain why so many of the pitches on Crowdcube do not follow this procedure and have what can only be described as floral bios for their founders - its in the Crowdcube DNA.

Thursday, 3 December 2015

Why HMRC data cannot be trusted.

We have been saying this for while. The data that HMRC hold on companies is not accurate. Filed Accounts and Annual Returns for SMEs are often fictitious.

Here's a classic example.

Bnktothefuture is an outfit we have mentioned before. We know they are liberal with the truth so it was a fair bet that their accounts wouldnt stack up. However we didnt expect the errors to be so blatantly obvious.

Taking its 3 years of accounts filed at Companies House to date, it should be easy to follow their progress. The way this works is that they only have to file a brief balance sheet annually and this is presented with the previous year's BS in the opposite column - sort of acts as an anchor from the start of the year to the end of the year.

What BTTF have done is move the anchor point each year so that whatever picture they want to paint comes out. So the filed original accounts for 2012/13 when they appear on the filed accounts the following year have substantial changes and so on to 2015. The original filing is not corrected to reflect these changes so we have a total mess.

This means that all of the accounts for this company are complete nonsense and its anyone's guess what the real accounts would say.

Of course this only matters because with the new Equity Crowdfunding, the information from HMRC on companies can be essential for making credible judgements.

The liberalisation of SME reporting was intended to ease the burden and expense of red tape. No auditing required, only basic balance sheet details wihtout notes are filed. It does make sense providing the SME's dont abuse it. It was never intended to work with ECf however.

Its impossible for HMRC to check all these annual accounts and the evidence is very plain that they dont. We are free wheeling down the hill towards the cliff.

Tuesday, 1 December 2015

Crowdcube EIS fund is spectacular failure

Surely this will send Crowdcube a much needed message - stop pitching rubbish businesses using ridiculous projections.

The failure of their EIS fund to raise even a third of the money they wanted is a victory for the Crowd. The platform may manipulate what people can say on their forums but they cant ignore this firm slap in the face. The Crowd does not trust your judgement.

Of course the Crowdcube Undertakers Dept will already have disposed of the body and the PRing Dept will be launching some counter to deflect. However they dress it up, the Crowd looked at what they offered and said very firmly NO thank you.

So what was on offer?

The Crowdcube EIS fund was launched in a cynical attempt to manipulate people with less time/knowledge to invest in Crowdcube pitches. It must have been as no one with either would have touched it. This in turn would have helped Crowdcube pitches complete - which is their source of revenue.

A few problems they hadnt thought about. The fund talked (as usual) about multiple ROI's within 5 years when the truth is only a single Crowdcube funded pitch has ROI'd in 4 years, against multiple failures and even this was tiny. You had to pay Crowdcube 'experts' to choose businesses for you. Looking back over the Crowdcube annual awards, many of these so called stars have gone bust already. Why would you want them choosing your failures when you can manage that tidily yourself?

It was just not credible. Which says a lot about the platform.

Monday, 30 November 2015

We have a new look for equity crowdfuding

An interesting comparison can be made between the many companies that have funded via the various ECf platforms since 2011 and one particular start up which took a different route - Tropic Skin Care.

Tropic has been trading for three years and to YE June 2014 showed quite remarkable results - turnover up from £600k to £2.5m, with profits of £400k. So whats the secret?

Well it appears to be fairly obvious. Lord Sugar is one the two directors and is the main funder behind the venture after the founder pitched the business idea to him on The Apprentice.

You would also have to factor in the dedication of the founder Susan Ma. As with many great entrepreneurs, she started making product in her kitchen and selling at markets - giving her invaluable insights into her customers' desires. The sort of insights ignored by the instant success junkies who seem to inhabit the ECf platforms. Between them they came up with what appears to be their eureka moment - a revamped Avon Lady scheme as their main sales driver.

It's fair to say that no company that has raised money on any ECf platform has achieved a tenth of this success. In fact there has been very little success full stop.

The big or rather massive, difference is in Lord Sugar's input. Money is required but there is no substitute for contacts and experience. These he has in spades. The investment appears very lite compared with most ECf pitches - a mere £200k of share capital recorded in the accounts.

So the lesson has to be that ECf by itself is not the cure all - businesses that are 'successful' in terms of raising money do not automatically go on to grow. In fact the evidence to date is that encouraging poorly planned businesses to raise using overstated projections ends in tears. You can be sure Sugar wouldnt be accepting the sort of ridiculous projections that the platforms promote.

The answer is...........combine an ECf platform with top notch business mentoring. Where are you?

What has happened at the ''Award Winning'' Pizza Rossa?

Pizza Rossa took Crowdcube by storm in 2013/14 when it raised £440k in 17 days.

It won various awards from the Crowdcube platform and was the winner of the LBS start up competition in 2013. The whole raise was based on the founders MBA credentials.

Seems it is harder to run a viable pizza business, using awards as the main ingredient, than they thought.

Shortly after the first Crowdcube success, the company had run out of cash and was back for more, raising another £160k this time. But no need to worry as the 'valuation' of the company had gone up 2.5 times! We have Crowdcube to thank for that. Of course predictions by us that their Saturday openings in the City wouldnt work, turned out to be true. How an MBA messed that up is anybody's guess.

So now they had the money, a little more experience and were good to go, toppings and all.

During an interview with Big Hospitality to promote the second raise, founder and chief executive of Pizza Rossa, Corrado Accardi stated, “We are confident that this new campaign will attract the attention of investors watching the steady growth of Pizza Rossa. Since we opened the first pop-up at Leadenhall Market in June, we have served in the region of 20,000 people – and that’s only a five-day a week operation. We opened at London Wall just three weeks ago, and we are extremely encouraged by the results to date. It seems that the City has really taken to Pizza Rossa, and it proves that our concept is right on target for this audience.”

Very sadly the new prime location at London Wall, seen here, has closed only a few days before its first birthday. No new openings have taken place anywhere since and the company that was to take over the London and then world pizza scene, has just one outlet, 3 years after first milking Crowdcube investors.

Very sadly the new prime location at London Wall, seen here, has closed only a few days before its first birthday. No new openings have taken place anywhere since and the company that was to take over the London and then world pizza scene, has just one outlet, 3 years after first milking Crowdcube investors.One lesson that most people with any savvy know, is that you dont build up a retail business opening and then closing units. It costs too much.

Accounts are not due out until next year but with an expensive shop fit, leases et al it will be sometime before this company gets back on track. First accounts since the initial raise were galaxies off the predictions.

It does seem odd to us that since this initial milking, nearly everything the CEO has predicted has turned out to be rubbish. Standards at LBS must have slipped somewhat since we went to Business School.

Surely we will have the pleasure of Corrado's silky tongue again - cash must be tight. Maybe he'll need to choose another platform this time though as the ever busy Crowdcube Undertakers Department are sure to box up his business shortly. We'll let know.

Sunday, 29 November 2015

Come on please dont insult our intelligence

This is Steven Segal - one time action hero, SEAL and cook. It's not what he looks like today, which is part of our point.

A new Crowdcube pitch is being sold with what can only be described as information sieve syndrome. It has more holes than facts.

The Founder of Po Zu is Steven Segal - no not the cook, the shoemaker. They make ethical shoes and have done so since 2002 or thereabouts.

This business may well be one that could make it - but not the way it has been laid out by Crowdcube.

For starters we are not given any historical financials. We are told that the new company Po Zu owns two subsiduaries, Po Zu Online and Fishwalk - both of them due to file accounts by end Dec2015 or in a months time. Why then are they not filed already? They must be hiding something. Fishwalk is insolvent and has a long term debt of £52k for YE March 2014. This debt appears to be cleared in the new holding company.

From previous years accounts both subsidiaries are loss making or just BE. Turnover appears tiny, assets almost zero. This may well be down to lack of marketing as the pitch explains. Turnover appears to be around the £100k mark, with projections of £350k for 2016 and then £1.6m 2017 etc etc.

The pitch claims that the founders have invested £20k in share capital but this is not in the financial statements. They are raising £150k now and this is the total share capital on the financial projections.

The brand name Po Zu is owned by the newco, but Steven has held back another trade name he owns, only licensing it to the newco.

All of the above is bad enough but then we get to the valuation. Oh Lord the valuation.

Steven has outdone himself proud here. Using the DCF method - with no historic data relevant to the turnover projected, they have come up with just under £1m - now. Its sheer genius.

Crowdcube posted this pitch so must have checked it. Their standards are slipping below the watermark. We need the real Steven to break down the doors and kung fu the lot of them.

Saturday, 28 November 2015

So what did happen to the Rushmore Group and £1.5m raised on Crowdcube

Its funny how the same people continue to crop up in the ECf world.

The Rushmore Group funded via Crowdcube in 2011/12/13. Its owned by John Downey.

They raised what was then a record £1m on the platform, followed by another £500k. They promised to use the money to open a new establishment in Soho, which would replace the burnt out East Room club, bringing the Group back into profit. The club in Soho was the Century club, named for its steps leading up from Shaftesbury Avenue.

Since then, John Downey's plans have gone a little bit off track.

Sure the Century club is up and running but not with the Rushmore Group - who now only have 2 London clubs. They closed Giant Robot Clerkenwell last year. Accounts filed for YE Dec 2014 show continued losses, now accumulated to £1.75m.

Apparently the Group is suing the former MD of The Century Club for £6m as the deal, agreed according to the Crowdcube out to lunch department, fell through. He seems to think he will get the £6m.

According to this article http://www.morningadvertiser.co.uk/Operators/Other-operators/Rushmore-Group-secures-further-funding the Group were due to open 3 new members clubs in 2014. They didnt manage one.

So what has John Downey been up to?

It would seem that he has got bored of Rushmore and its 300 investors and is now full time with a new project, London Union. You could say that the Rushmore experience has taught him a few things. He is now raising £3m for his new project on Seedrs, another ECf platform. The pitch closes today, over its threshold figure of £1m and with 102 investors. We assume not many of them from the Rushmore experience.

Interestingly none of this is mentioned in the Seedrs pitch. In fact the bio for Downey doesnt ever mention Rushmore, only referring to one of its two remaining clubs.

This is not untypical of the outcomes that have befallen businesses funded via Crowdcube in 2012/13 and we can assume it will continue to be so. Investors have no control over either business or the management - they do as they please. Mind the wreck on your way out.

Friday, 27 November 2015

Crowdcube's incessant over optimism is a sales tool.

It's nice to occasionally come across an indisputable fact.

Cell Therapy raised almost £700k on Crowdcube at the turn of the year - some achievement as it had only asked for £250k. The company has some groundbreaking regenerative cell therapies and is backed by some industry giants. It may well go on to be one of Crowdcube's major successes. See here http://www.celltherapyltd.com/pdfs/Financial-Times-article-Oct-4th-2015-Cell-Therapy-Ltd-eyes-initial-public-offeringFT.com.pdf

At this stage however, with the YE accounts to July 2015 just filed, they are a long way from where the Crowdcube pitch put them only months ago.

In the pitch, they stated that the Director's loan of £57k would remain in the company. The accounts show it has been repaid.

In the pitch they stated -

Cell Therapy is scheduled to complete a public listing on Jan 14th 2015 on the Euromarket GXG exchange at an initial valuation of £100M (~£50 per share). This Crowdcube funding is the final private placement prior to listing with a pre-IPO discount of over 25% at a £64M valuation (£37.00 per share).

This listing never took place and they have sold more private equity since.

In the pitch it shows capital invested into the company by now of £15.5m. The accounts show £2.5m has been invested, with another £2m plus invested since.

In the pitch it shows a turnover for YE Dec 2015 of £3.9m. In the accounts the turnover is zero. This would appear to be due to the delay (or collapse) of a licensing agreement with a Chinese company.

So you can see that pretty well everything in the pitch turned out to be grossly over optimistic. Investors need to know that this is common place on the Crowdcube site. All of the companies we have accounts for, to compare to their projections, bar one, have failed to get close to those projections.

Of course it doesnt mean that Cell Therapy wont go on to be worth hundreds of millions - it just means that it wont be worth that now, as predicted.

The point here is a wider one - Crowdcube pitches are always ridiculously over optimistic - it's part of their sales arsenal. So just be aware.

More information asymmetry on Crowdcube

Is this really the way we want equity crowdfunding to function in the UK. Companies giving us as little information as they can get away with.

Shouldnt we be asking for all relevant information about a company and its directors to be laid out in the open from the start?

A new pitch on the one platform that has a history of not telling us everything, illustrates the problem. If one assumes that Crowdcube did a little due diligence then they are sure to have known all the facts and therefore chose not to share some of them with us.

So this company is in the health sector and is run by someone with 25 years start up experience in this market. None of his experiences adds up to much until you come across one company that was liquidated recently. The company's shortfall was over £1m, much of that owed to a national bank. As part of the enquiry into the liquidation, a member of staff at the company reported that there had been some discrepencies with the use of invoice factoring - the factors being an arm of said bank. The report goes on to say that the bank was pursuing this independently.

Most of the other companies he is listed as starting have either not traded and closed or are trading with a negative value. This is not as described on Crowdcube.

We all know that business is a risky venture where things can go wrong. So liquidating a company should not be the end of the world. However with the invoice issues in this case and the current description in the Crowdcube pitch, we are not really being given an adequate level of information. Information that Crowdcube must have chosen to leave out of the pitch. No one could deny its relevance to investing in this new venture. Why would they leave it? Hmmm.

Another aspect of this pitch, which we feel happens far too often, is a lack of clarity of the founders investment. According to the Crowdcube verified financials, no investment has been put into the company to date. Yet the pitch talks about the founders investment. As soon as it was live, the pitch received a single investment of £110k. As there is no evidence given as to where this is from and the total investment at the completion of this round is £360k (the pitch's raise figure) then we have to assume this £110k is from the founders. So why not say so?

You would have thought that after 4 years of running this platform with FCA and UK government backing, Crowdcube would be trying to help investors make sensible decisions, not blindfolding them into crass ones.

Saturday, 21 November 2015

My Date ......you're Late

Mymateyourdate raised £145k on Crowdcube in January this year. The value of their company was then said to be £650k.

Now they are back on CC, raising £75k at an increased value of £1m.

So what takes a start up from an opening £650k to £1m or an increase of 50% in just 10 months?

Certainly not turnover - projected to be £244k for YE Dec 2015 in the C pitch from January but coming in at £19 for the year. Yes that's nineteen pounds and no pence. Mind that gap.........

Of course the new pitch doesnt mention the January projections - why would it, it might put people off.

So what's missing?

Well it seems that in the January raise, the company aimed to have VC investment of £1.5m in place this year. This never materialised and the new pitch just reiterates the January pitches mantra that a VC round will be on stream in 2016. We dont know why the VCs were not interested in 2015 but the company is sure they will be in 2016. Keep then waiting....makes then keener, sort of approach maybe?

Interestingly the company had a £42k 3 year loan with a related Co. in Australia - where the founders come from. This has been reduced in the year to £27k - presumably using funds raised via the January equity raise. Naughty that.

All in all this pitch doesnt tell you much about what they have previously promised and what they have actually delivered. It should do that up front and then see if people want to invest.

What the fudge are Crowdcube playing at?

There is only one thing you can be sure of with a mirage - what you see is not what is there. Or is it?

The Lifestyle Hospitality Group are raising £500k on Crowdcube, valuing themselves at just over £8m. As valuations go, that one went.

Its hard to know where to start with this one - complicated company structure, connection to some 'consulting' firm in Dubai, £200k redeemable pref shares which CC have wrongly described, advice from CC that anyone investing should get independent legal advice, a brand name they seem to have sold to a third party..........and reviews for their restaurants which include some of the worst we have ever seen.

Lets start with the redpref shares. CC fail to mention that they are redeemable at any stage with a 51% vote by A shareholders - ie the related owners of the business. 75% of the £200k is owned by an OVM Consulting in Dubai. They have no record anywhere on the net and appeared when the previous owner of the shares left the company. For all we know this could be a front for the existing owners, who own the other 25%. At any stage £200k could be taken out of the company.

So thats clear - what about the CC steer that all investors should take independent legal advice on this one. So for example you want to invest £500 and take this advice, which costs you £1500 in fees. Why, well because CC couldnt be bothered to do the DD themselves. I suppose its helpful in one way, as at least we now all know that CC agree with us that their DD stinks.

Then there's the reviews. Bit of thorny issue web reviews - can they be trusted? Well probably no, so what we do is look at a selection of the good and the bad and see what they say. Now for a company predicting world growth, you would expect the reviews to be good to great with the usual smattering of whingers. Here we have a large number of average to poor, to down right catastrophic reviews, from all their venues. Many of them very recent. It doesnt look like they have tied down the model quite yet.

Its surprising that CC would offer this company up as an investment for its group of loyal followers. Its suggests an ever increasing desperation on their part but people really arent that stupid.......are they?

The Lifestyle Hospitality Group are raising £500k on Crowdcube, valuing themselves at just over £8m. As valuations go, that one went.

Its hard to know where to start with this one - complicated company structure, connection to some 'consulting' firm in Dubai, £200k redeemable pref shares which CC have wrongly described, advice from CC that anyone investing should get independent legal advice, a brand name they seem to have sold to a third party..........and reviews for their restaurants which include some of the worst we have ever seen.

Lets start with the redpref shares. CC fail to mention that they are redeemable at any stage with a 51% vote by A shareholders - ie the related owners of the business. 75% of the £200k is owned by an OVM Consulting in Dubai. They have no record anywhere on the net and appeared when the previous owner of the shares left the company. For all we know this could be a front for the existing owners, who own the other 25%. At any stage £200k could be taken out of the company.

So thats clear - what about the CC steer that all investors should take independent legal advice on this one. So for example you want to invest £500 and take this advice, which costs you £1500 in fees. Why, well because CC couldnt be bothered to do the DD themselves. I suppose its helpful in one way, as at least we now all know that CC agree with us that their DD stinks.

Then there's the reviews. Bit of thorny issue web reviews - can they be trusted? Well probably no, so what we do is look at a selection of the good and the bad and see what they say. Now for a company predicting world growth, you would expect the reviews to be good to great with the usual smattering of whingers. Here we have a large number of average to poor, to down right catastrophic reviews, from all their venues. Many of them very recent. It doesnt look like they have tied down the model quite yet.

Its surprising that CC would offer this company up as an investment for its group of loyal followers. Its suggests an ever increasing desperation on their part but people really arent that stupid.......are they?

Friday, 20 November 2015

What to do with Altfi Data's ECf report?

Altfi Data have produced a report on the UK equity crowdfunding sector: Where Are they Now?

What can say about it. Well to be frank not very much that's good. As they themselves admit on several occasions, the data they have had to use is very sparse. Much of what they do use has either been interpreted and or been supplied by the very platforms they are analysing. They have not spoken to a single investor or analysed a single failed business.

Even when they do get down to some facts, they get it wrong. An important consequence of ECf is its abaility to increase employment, escpecially as the whole scheme is heavily backed with EIS and SEIS tax reliefs. This report headlines - ''Headcount increases at Crowdfuned companies''. This section goes on to show how this increase is on average 83% post funding. They even have a nice graphic to explain it.

However, if you read on they state - '' Around 25% of the companies we

surveyed disclosed a change in headcount and of those

the average increase after fund raises was 83%.'' To extrapolate this into an overall increase of 83% for all companies that have crowdfunded is nonsense. In fact it castes serious doubts on the any other conclusion the report might make. It's simply a schoolboy error.

In its analysis of the performance of companies since funding, the report again is floundering. It states that data from 2011 is too sparse and that data since, doesnt really tell us much becasue of the way HMRC have set up SME accounting. Yet it goes on to make what can only be politely described as pure guesswork conclusions.

We know that this part of the report is wrong because we have a large number of the original pitch financials against which to compare the companies' progress. Failure rates at this early stage are irrelevant - they will only start to become measurable in 2017 and beyond. We can state here that very few companies manage to get close to the projections they issued to entice ECf investment.

We believe that these projections should also be lodged with an overseeing organisation, be it the FCA or HMRC and then be accessible to relevant parties in the future. This system, which is part of the new SEC regs in the US, would help investors make sensible decisions and prevent Alice in Wonderland becoming a reality.

Another of the report's obvious flaws is the weighting. As it reveals, Crowdube have funded more than the other 4 platforms added together, yet they are not given any weighting in the analysis. As Crowdcube run a very different model to all the other platforms, this hides the real results.

In its final conclusion, the report does at least acknowledge the need for more transparency, something some of us have been banging on about for years. It does seem a shame that a report, which will go on to be held up by the platforms as proof they are getting it right, is unable to fly.

Addendum - after writing this the CEO of Altfi Data contacted us to say that

they agreed the wording on the staffing levels was confusing but the data was essentially correct. We dont agree - the 83% figure is just nonsense.

Further he revealed that in the data sets used, they did not allow for the companies that had closed. Another clear catastrophic error. Companies that had employed 5 people, then ecrowdfunded, overtraded and had gone bust are not included. The whole report is so strewn with basic analytical mistakes as to make it totally worthless.

Enistic withdraw their Crowdcube pitch

Enistic were until very recently trying to raise £150,000 on Crowdcube. The pitch wasnt going too well, but then quite a few on Crowdcube seem to be struggling.

They had a very high rating from Crowdrating - two golds and a silver, which is pretty well the highest rating they can give. So if you believe what Crowdrating say this pitch was as good a bet as you can get. Enistic also formed part of the portfolio of Braveheart - Crowdcube's Venture fund. In other words, it has the backing of Crowdcube's experts.

So where have they gone and why?

We may never know. Crowdcube run their platform firstly for themselves and secondly for entrepreneurs. Investors, or as some might like to call them, its clients, are almost always left in the dark. This is just one example alongside more obvious ones like 88 Delicious, where it would be very beneficial for potential investors to know why a pitch has gone off line.

We are left to fill in the blanks.

They had a very high rating from Crowdrating - two golds and a silver, which is pretty well the highest rating they can give. So if you believe what Crowdrating say this pitch was as good a bet as you can get. Enistic also formed part of the portfolio of Braveheart - Crowdcube's Venture fund. In other words, it has the backing of Crowdcube's experts.

So where have they gone and why?

We may never know. Crowdcube run their platform firstly for themselves and secondly for entrepreneurs. Investors, or as some might like to call them, its clients, are almost always left in the dark. This is just one example alongside more obvious ones like 88 Delicious, where it would be very beneficial for potential investors to know why a pitch has gone off line.

We are left to fill in the blanks.

Thursday, 19 November 2015

Crowdcube's pitches still on the game

We had assumed that by now, what with all the hard work we are doing FOC, that Crowdcube pitches would have reached a reasonable level of DD.

Apparently not.

The latest company to fall short of the 'honesty' line is Perks Loyalty. They value their company at £1.75m - as complete start up.

So you are thinking well the guys involved must be some big hitters. The sole director, an ex footballer, has a few other companies but only one that you could call established, Top Screen Media Ltd. He is ''a leading expert in digital innovation' according to Crowdcube. Top Screen trades at a loss.

We dont have a problem with any of the above. However a very casual glance at his Top Screen Media business rings alarm bells. On this website, he very sensibly has 'Case Studies' to illustrate the benefits of the service the company offers.